Wajax announces 2014 second quarter earnings

TORONTO, Aug. 6, 2014 /CNW/ - Wajax Corporation ("Wajax" or the "Corporation") today announced its 2014 second quarter earnings.

Second Quarter Highlights

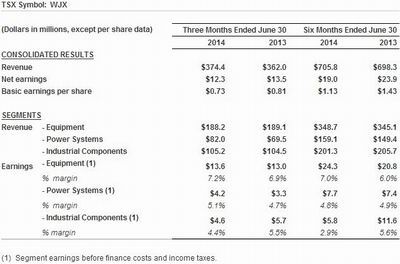

Consolidated second quarter revenue of $374.4 million increased $12.4 million, or 3%, compared to last year. The Power Systems segment recorded an 18% increase in revenue over the previous year, primarily on stronger power generation sales and improved off-highway activity in the western Canada oil and gas sector. Revenue in the Industrial Components and Equipment segments were relatively unchanged from the previous year.

Net earnings for the quarter of $12.3 million, or $0.73 per share, decreased compared to $13.5 million, or $0.81 per share recorded in 2013. The lower earnings were mainly attributable to higher finance costs resulting from the increased cost of debt related to the issuance of long-term senior notes in the fourth quarter of last year, as well as a slightly higher income tax rate. Higher gross profit margins from improved parts and service volumes increased Equipment segment earnings 4% over the previous year, to $13.6 million, despite a $0.5 million charge for the closure of one and temporary shutdown of another British Columbia mining branch. Power Systems segment earnings increased 27% from 2013, to $4.2 million, on the increase in revenue, while Industrial Components segment earnings decreased 19%, to $4.6 million, on higher selling and administrative costs.

Consolidated backlog at June 30, 2014 of $224.5 million increased $66.7 million, or 42%, compared to March 31, 2014 on increases in all three segments.

Funded net debt of $218.2 million at June 30, 2014 was relatively unchanged compared to $217.8 million at March 31, 2014.

The Corporation disclosed that it expects to take a restructuring provision in the third quarter of 2014 of between $3.0 million and $3.6 million related to the Industrial Components segment. This provision will consist primarily of severance costs, as Industrial Components simplifies its sales organization. Annual pre-tax cost savings as a result of this restructuring are expected to be approximately $5.0 million.

Wajax also reported that it has amended its bank credit facility, extending the maturity a further three years to August 12, 2019 on more favourable terms than its previous agreement. The new terms include the allowance for dividend payments as long as the Corporation's Debt-to-EBITDA ratio (see the MD&A Liquidity and Capital Resources and the MD&A Non-GAAP and Additional GAAP Measures sections) is less than 3.25x, which is 0.25x higher than the previous agreement and equal to the level in the senior notes agreement.

Wajax also announced that monthly dividends of $0.20 per share were declared for the months of August, September and October.

Outlook

Commenting on second quarter results and the outlook for the remainder of 2014, Mark Foote, President and CEO, stated:

"As expected, second quarter earnings showed improvement compared to the first quarter of this year. The Equipment and Power Systems segments each posted improved earnings compared to the previous year despite a $0.5 million charge in the Equipment segment related to downsizing its branch operations primarily due to a slow-down in British Columbia coal mining activity. In the Industrial Components segment, trends continued to improve from the first quarter.

We are pleased with our 42% increase in backlog over the first quarter and in particular with the increased orders for oil sands related mining shovels.

During the quarter we transferred accountability for the oil sands based rotating products group from the Equipment segment to the Industrial Components segment and the impact of the transfer was reflected in the segment results for the quarter and comparative periods. The change will allow for a stronger foundation for operations in the oil sands by exploiting the engineering and repair services capabilities in Industrial Components and provides a platform for future expansion into other Canadian mining markets. We also announced plans to restructure and simplify the sales force at Industrial Components, which is expected to result in improved sales team effectiveness and lower costs. We are very committed to growth at Industrial Components with particular emphasis on the addition of products and value-added services in support of our oil sands, mining and oil and gas customers.

Heading into the third quarter, the outlook for our end markets and results for the full year, excluding the expected restructuring provision, remains substantially unchanged from our view at the end of the first quarter. While we continue to expect 2014 to be a challenging year, we are beginning to see encouraging signs of increased capital spending from oil and gas customers and we are pleased with our oil sands activity. Our increased backlog and the restructuring in the Industrial Components segment gives us added confidence as we continue to make investments in our strategic growth initiatives. As a result, we have maintained our monthly dividend at $0.20 per share, keeping to our guideline of paying out at least 75% of current year expected earnings."

Wajax Corporation

Wajax is a leading Canadian distributor engaged in the sale, rental and after-sale parts and service support of equipment, power systems and industrial components, through a network of 121 branches across Canada. The Corporation is a multi-line distributor and represents a number of leading worldwide manufacturers across its core businesses. Its customer base is diversified, spanning natural resources, construction, transportation, manufacturing, industrial processing and utilities.

Wajax will Webcast its Second Quarter Financial Results Conference Call. You are invited to listen to the live Webcast on Wednesday, August 6, 2014 at 2:30 p.m. ET. To access the Webcast, enter www.wajax.com and click on the link for the Webcast on the Investor Relations page.

TORONTO, Aug. 6, 2014 /CNW/ - Wajax Corporation ("Wajax" or the "Corporation") today announced its 2014 second quarter earnings.

Second Quarter Highlights

Consolidated second quarter revenue of $374.4 million increased $12.4 million, or 3%, compared to last year. The Power Systems segment recorded an 18% increase in revenue over the previous year, primarily on stronger power generation sales and improved off-highway activity in the western Canada oil and gas sector. Revenue in the Industrial Components and Equipment segments were relatively unchanged from the previous year.

Net earnings for the quarter of $12.3 million, or $0.73 per share, decreased compared to $13.5 million, or $0.81 per share recorded in 2013. The lower earnings were mainly attributable to higher finance costs resulting from the increased cost of debt related to the issuance of long-term senior notes in the fourth quarter of last year, as well as a slightly higher income tax rate. Higher gross profit margins from improved parts and service volumes increased Equipment segment earnings 4% over the previous year, to $13.6 million, despite a $0.5 million charge for the closure of one and temporary shutdown of another British Columbia mining branch. Power Systems segment earnings increased 27% from 2013, to $4.2 million, on the increase in revenue, while Industrial Components segment earnings decreased 19%, to $4.6 million, on higher selling and administrative costs.

Consolidated backlog at June 30, 2014 of $224.5 million increased $66.7 million, or 42%, compared to March 31, 2014 on increases in all three segments.

Funded net debt of $218.2 million at June 30, 2014 was relatively unchanged compared to $217.8 million at March 31, 2014.

The Corporation disclosed that it expects to take a restructuring provision in the third quarter of 2014 of between $3.0 million and $3.6 million related to the Industrial Components segment. This provision will consist primarily of severance costs, as Industrial Components simplifies its sales organization. Annual pre-tax cost savings as a result of this restructuring are expected to be approximately $5.0 million.

Wajax also reported that it has amended its bank credit facility, extending the maturity a further three years to August 12, 2019 on more favourable terms than its previous agreement. The new terms include the allowance for dividend payments as long as the Corporation's Debt-to-EBITDA ratio (see the MD&A Liquidity and Capital Resources and the MD&A Non-GAAP and Additional GAAP Measures sections) is less than 3.25x, which is 0.25x higher than the previous agreement and equal to the level in the senior notes agreement.

Wajax also announced that monthly dividends of $0.20 per share were declared for the months of August, September and October.

Outlook

Commenting on second quarter results and the outlook for the remainder of 2014, Mark Foote, President and CEO, stated:

"As expected, second quarter earnings showed improvement compared to the first quarter of this year. The Equipment and Power Systems segments each posted improved earnings compared to the previous year despite a $0.5 million charge in the Equipment segment related to downsizing its branch operations primarily due to a slow-down in British Columbia coal mining activity. In the Industrial Components segment, trends continued to improve from the first quarter.

We are pleased with our 42% increase in backlog over the first quarter and in particular with the increased orders for oil sands related mining shovels.

During the quarter we transferred accountability for the oil sands based rotating products group from the Equipment segment to the Industrial Components segment and the impact of the transfer was reflected in the segment results for the quarter and comparative periods. The change will allow for a stronger foundation for operations in the oil sands by exploiting the engineering and repair services capabilities in Industrial Components and provides a platform for future expansion into other Canadian mining markets. We also announced plans to restructure and simplify the sales force at Industrial Components, which is expected to result in improved sales team effectiveness and lower costs. We are very committed to growth at Industrial Components with particular emphasis on the addition of products and value-added services in support of our oil sands, mining and oil and gas customers.

Heading into the third quarter, the outlook for our end markets and results for the full year, excluding the expected restructuring provision, remains substantially unchanged from our view at the end of the first quarter. While we continue to expect 2014 to be a challenging year, we are beginning to see encouraging signs of increased capital spending from oil and gas customers and we are pleased with our oil sands activity. Our increased backlog and the restructuring in the Industrial Components segment gives us added confidence as we continue to make investments in our strategic growth initiatives. As a result, we have maintained our monthly dividend at $0.20 per share, keeping to our guideline of paying out at least 75% of current year expected earnings."

Wajax Corporation

Wajax is a leading Canadian distributor engaged in the sale, rental and after-sale parts and service support of equipment, power systems and industrial components, through a network of 121 branches across Canada. The Corporation is a multi-line distributor and represents a number of leading worldwide manufacturers across its core businesses. Its customer base is diversified, spanning natural resources, construction, transportation, manufacturing, industrial processing and utilities.

Wajax will Webcast its Second Quarter Financial Results Conference Call. You are invited to listen to the live Webcast on Wednesday, August 6, 2014 at 2:30 p.m. ET. To access the Webcast, enter www.wajax.com and click on the link for the Webcast on the Investor Relations page.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Altra Industrial Motion Corp. to Present at Jefferies 2014 Global Industrials Conference

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.