October U.S. Machine Tool Orders Reveal Weaknesses in Manufacturing

“While the general economy continues to grow at a moderate pace, the manufacturing sector is struggling with the effects of a strong dollar, reduced commodity prices, especially oil, and struggles in key export markets like China,” commented AMT president Douglas K. Woods.

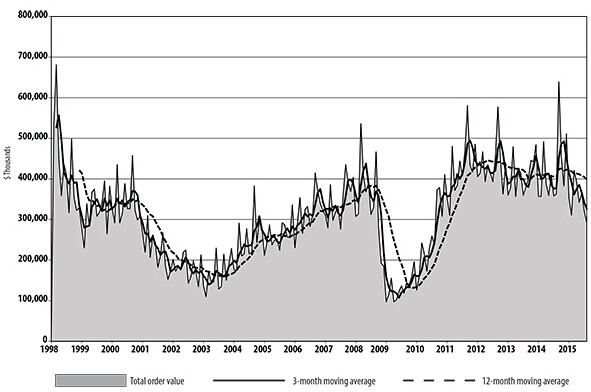

New orders for machine tools and related technology dipped only slightly from September to October, falling 0.3% to $327.4 million, according to data reported by AMT – the Association for Manufacturing Technology in its latest U.S. Machine Tools Orders report. It was the second-consecutive monthly increase in order volumes, an encouraging detail in what has been a 15-month stall in overall growth for the manufacturing technology sector.

The October result is 28.3% lower than the October 2014 posting, and for the year-to-date the USMTO ($3.45 billion) shows a 17.4% decline in order volume versus the comparable 10-month period of 2014.

AMT’s monthly USMTO results are based on actual machine tool orders reported by participating companies who produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. While it is not reflective of manufacturing activity, as an indicator of capital investment it represents a gauge of manufacturers’ confidence in future activity.

“While the general economy continues to grow at a moderate pace, the manufacturing sector is struggling with the effects of a strong dollar, reduced commodity prices, especially oil, and struggles in key export markets like China,” commented AMT president Douglas K. Woods. “As the broader industry faces this slowdown, manufacturers are not making significant capital investment in new manufacturing technology.”

In its release, AMT noted that U.S. GDP is forecast to grow 2.4% in 2015, largely on the strength of consumer spending. “Economic data around manufacturing isn’t as positive,” the association averred, offering the contraction in the economy revealed in the Purchasing Managers Index in the October by the Institute for Supply Management.

“Additionally, the number of ‘net manufacturing jobs’ dropped by 1,000 while the larger economy added 211,000 jobs,” AMT added. “The ISM report and other indicators also show that manufacturers are working to reduce their

excess inventory, meaning companies are concerned with the prospects for short-term future growth.”

“Market flatness can be expected to remain into 2016, and signs pointing to short-term interest rate hikes from the Federal Reserve could potentially hamper the consumer spending that is currently driving economic growth,” Woods cautioned. “Manufacturing is the real driver of sustainable economic growth, and tax provisions, such as bonus depreciation and Sec. 179 expensing, encourage the investment in plants and equipment necessary for manufacturing strength and competitiveness. Factories don’t have a great deal of excess capacity, meaning any uptick in activity could help the manufacturing economy bounce back.”

Each USMTO report includes the results of machine tool orders from six regions of the industry. In the Northeast region, metal-cutting equipment orders fell 8.9% from September and fell 14.6% the October 2014 report. For the year-to-date, total new orders in the Northeast region stand at $660.52 million, down just 1.4% compared to the same period of last year.

In the Southeast, metal-cutting equipment orders declined 15.9% from September, but increased 14.9% over October 2014 new orders. For the 10 months of 2015, total new orders in the Southeast region total $368.53 million, down 5.1% versus the first 10 months of 2014.

The North Central-East region reported total manufacturing technology orders rose 7.6% during October, up to $103.4 million, though that figure is 12.8% less than the October 2014 total. For the year-to-date, new orders in the North Central-East region stand at $984.3 million, 11.4% less than the January-October 2014 total.

The North Central-West region reported metal-cutting machinery orders fell 20.8% from September, and fell 48.3% from October 2014. For the current 10 months of 2015, total new orders for manufacturing technology in the North Central-West region total $640 million, 13.1% less than the comparable period of 2014.

In the South Central region new orders for metal-cutting equipment increased 43.0% from September to $18.7 million, but by comparison to October 2014 totals the new figure is down 72.0%. For the year-to-date, total new orders for manufacturing technology in the South Central region are 60.0% less than the 10-month result for 2014.

Finally, in the West, new orders for metal-cutting equipment rose 16.9% from September to October, to $57.25 million. That figure is 18.7% less than the October 2014 result. For the year-to-date, total new orders for manufacturing technology in the West amount to $539.22 million, 13.5% less than the January-October total for 2014.

“While the general economy continues to grow at a moderate pace, the manufacturing sector is struggling with the effects of a strong dollar, reduced commodity prices, especially oil, and struggles in key export markets like China,” commented AMT president Douglas K. Woods.

New orders for machine tools and related technology dipped only slightly from September to October, falling 0.3% to $327.4 million, according to data reported by AMT – the Association for Manufacturing Technology in its latest U.S. Machine Tools Orders report. It was the second-consecutive monthly increase in order volumes, an encouraging detail in what has been a 15-month stall in overall growth for the manufacturing technology sector.

The October result is 28.3% lower than the October 2014 posting, and for the year-to-date the USMTO ($3.45 billion) shows a 17.4% decline in order volume versus the comparable 10-month period of 2014.

AMT’s monthly USMTO results are based on actual machine tool orders reported by participating companies who produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. While it is not reflective of manufacturing activity, as an indicator of capital investment it represents a gauge of manufacturers’ confidence in future activity.

“While the general economy continues to grow at a moderate pace, the manufacturing sector is struggling with the effects of a strong dollar, reduced commodity prices, especially oil, and struggles in key export markets like China,” commented AMT president Douglas K. Woods. “As the broader industry faces this slowdown, manufacturers are not making significant capital investment in new manufacturing technology.”

In its release, AMT noted that U.S. GDP is forecast to grow 2.4% in 2015, largely on the strength of consumer spending. “Economic data around manufacturing isn’t as positive,” the association averred, offering the contraction in the economy revealed in the Purchasing Managers Index in the October by the Institute for Supply Management.

“Additionally, the number of ‘net manufacturing jobs’ dropped by 1,000 while the larger economy added 211,000 jobs,” AMT added. “The ISM report and other indicators also show that manufacturers are working to reduce their

excess inventory, meaning companies are concerned with the prospects for short-term future growth.”

“Market flatness can be expected to remain into 2016, and signs pointing to short-term interest rate hikes from the Federal Reserve could potentially hamper the consumer spending that is currently driving economic growth,” Woods cautioned. “Manufacturing is the real driver of sustainable economic growth, and tax provisions, such as bonus depreciation and Sec. 179 expensing, encourage the investment in plants and equipment necessary for manufacturing strength and competitiveness. Factories don’t have a great deal of excess capacity, meaning any uptick in activity could help the manufacturing economy bounce back.”

Each USMTO report includes the results of machine tool orders from six regions of the industry. In the Northeast region, metal-cutting equipment orders fell 8.9% from September and fell 14.6% the October 2014 report. For the year-to-date, total new orders in the Northeast region stand at $660.52 million, down just 1.4% compared to the same period of last year.

In the Southeast, metal-cutting equipment orders declined 15.9% from September, but increased 14.9% over October 2014 new orders. For the 10 months of 2015, total new orders in the Southeast region total $368.53 million, down 5.1% versus the first 10 months of 2014.

The North Central-East region reported total manufacturing technology orders rose 7.6% during October, up to $103.4 million, though that figure is 12.8% less than the October 2014 total. For the year-to-date, new orders in the North Central-East region stand at $984.3 million, 11.4% less than the January-October 2014 total.

The North Central-West region reported metal-cutting machinery orders fell 20.8% from September, and fell 48.3% from October 2014. For the current 10 months of 2015, total new orders for manufacturing technology in the North Central-West region total $640 million, 13.1% less than the comparable period of 2014.

In the South Central region new orders for metal-cutting equipment increased 43.0% from September to $18.7 million, but by comparison to October 2014 totals the new figure is down 72.0%. For the year-to-date, total new orders for manufacturing technology in the South Central region are 60.0% less than the 10-month result for 2014.

Finally, in the West, new orders for metal-cutting equipment rose 16.9% from September to October, to $57.25 million. That figure is 18.7% less than the October 2014 result. For the year-to-date, total new orders for manufacturing technology in the West amount to $539.22 million, 13.5% less than the January-October total for 2014.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Walter Meier sells machine tool business

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.