Excavator sales increased by over 18% in the 2025 first three quarters

Since entering 2025, the excavator market has been reporting positive news.

With the release of September data, the tone for the first three quarters of 2025 has been set. The excavator market demonstrated strong recovery momentum in the first three quarters, driven by both domestic demand and overseas exports, propelling the industry into an upward trajectory. September's sales and exports both set new record highs for the same period, signaling a comprehensive recovery in the industry's economic outlook.

Impressive Data: Both Volume and Structure Improve

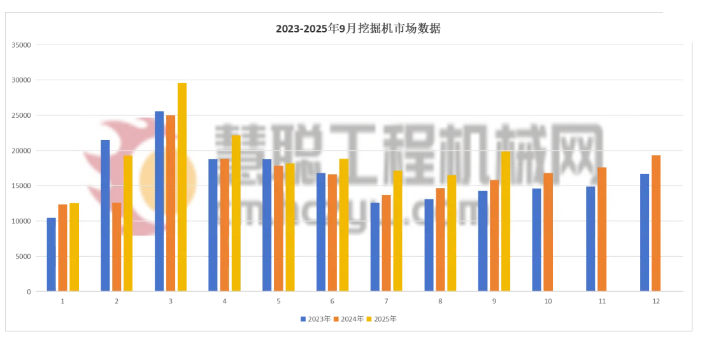

Data shows that from January to September 2025, cumulative sales of excavators in my country reached 174,039 units, an 18.1% year-on-year increase.

The market structure continued to optimize, with domestic sales of 89,877 units, a year-on-year increase of 21.5%; export sales of 84,162 units, a year-on-year increase of 14.6%, with both domestic and foreign demand showing steady growth.

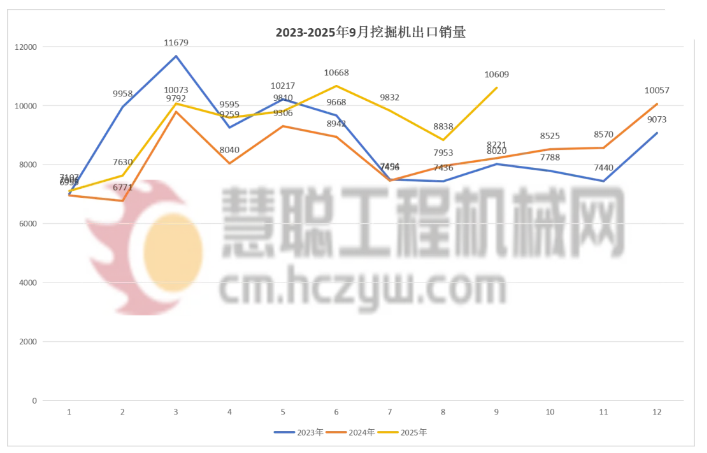

Particularly noteworthy was the monthly performance in September. Total excavator sales in September reached 19,858 units, a significant year-on-year increase of 25.4%. Exports reached 10,609 units, a record high for the same period, with a year-on-year increase of 29%.

Exports also accounted for 53.4% of total sales, indicating that overseas sales have become the primary driver of industry growth.

Driving Factors: Domestic Demand Policies Resonate with the External Demand Market

This growth is the result of a combination of multiple favorable factors.

In the domestic market, the supporting effect of macroeconomic policies and a robust equipment replacement cycle are the core drivers. Since 2025, China has continued to invest heavily in major infrastructure projects, such as the hydropower development of the lower reaches of the Yarlung Zangbo River and the construction of the Xinjiang-Tibet Railway. These mega-projects have provided a wide range of application scenarios for construction machinery. Furthermore, equipment from the previous sales peak (roughly 2016-2021) is entering its 8-10 year replacement cycle, unleashing a massive demand for rigid replacements.

In overseas markets, Chinese excavators are demonstrating increasing global competitiveness. Export markets have gradually expanded from their early focus on Southeast Asia to a wide range of countries and regions along the Belt and Road Initiative, including the Middle East, Latin America, and Africa.

Recently, in the "Dialogue" program, leading figures in the Chinese construction machinery industry, including Sany Heavy Industry, China Railway Construction Heavy Industry, and Liugong Group, shared an in-depth analysis of the core logic behind China's overseas growth and its future development path. They pointed out that Chinese brands are shifting from "exporting products" to "exporting industries," and from "going global" to "going in." Not only do they offer advantages in price-performance ratio, but rapid improvements in product quality, technical performance, and after-sales service networks are also driving a shift in the export structure from simply "quantity growth" to "quality improvement." The proportion of high-end models and the average export price have both steadily increased.

At the same time, Chinese construction machinery companies are also continuously evolving their overseas expansion strategies, gradually shifting from product exports to localized production capacity development. Leveraging their strengths in electrification and intelligent technologies, they are actively expanding into diverse markets and achieving deeper global operations.

Trend Outlook: Electrification and Recovery of the Entire Industry Chain

In addition to sales growth, profound structural changes are also taking place within the industry.

The electrification and intelligentization of construction machinery have moved from conceptual exploration to intensive implementation, becoming a core track for leading companies to build future competitiveness.

In terms of electrification, the driving force is shifting from policy environmental requirements to economic advantages throughout the entire life cycle. This is particularly true in fixed scenarios such as ports and mines, where electric equipment demonstrates its value with its lower operating costs.

In the intelligent field, technology applications are leaping from remote control and assisted operations of single machines to swarm intelligence, addressing labor shortages and improving construction accuracy and safety.

Overall, the deep integration of "electric drive" and "intelligent control" will reshape product formats and drive the industry's transformation from "selling equipment" to providing "integrated solutions," providing a historic opportunity for Chinese companies to overtake competitors in the global market.

Furthermore, the industry's recovery is extending beyond excavators to other product categories. Sales of loaders, concrete machinery, cranes, and other products have also begun to recover, following the recovery of excavators. This indicates that the foundations of this recovery are more solid and comprehensive, and that this trend has gradually spread from leading indicators to the entire construction machinery sector.

Looking ahead, industry insiders predict that the high prosperity of the excavator industry is expected to continue in the fourth quarter, coupled with the continued implementation of domestic growth stabilization policies and strong demand in overseas markets.

The Chinese construction machinery industry is entering a new round of rapid development, driven by the dual engines of "recovering domestic demand" and "accelerated overseas expansion."

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.