Magnetic Bearing Compressor Industry Outlook and Forecast 2025-2031

AI and "Dual Carbon" Ignite Demand, Magnetic Levitation Compressors Enter a "Golden Window"

1. Overview of the Magnetic Levitation Compressor Industry

Magnetic levitation compressors are an important type of compressor, which can be classified into various forms according to their structure, including rotary, scroll, piston, screw, and centrifugal compressors. Magnetic levitation compressors mainly fall under the category of centrifugal compressors. Compared with traditional compressors, magnetic levitation compressors use magnetic levitation technology to achieve contactless rotor levitation, thereby significantly reducing mechanical friction losses, improving operating efficiency, and extending equipment lifespan. These compressors are usually equipped with variable frequency drive motors, which can automatically adjust the operating speed according to the actual load and condensing temperature, helping to achieve effective control of the entire life cycle cost. In addition, magnetic levitation compressors support 100% oil-free operation, which not only simplifies the overall system structure but also significantly reduces maintenance costs.

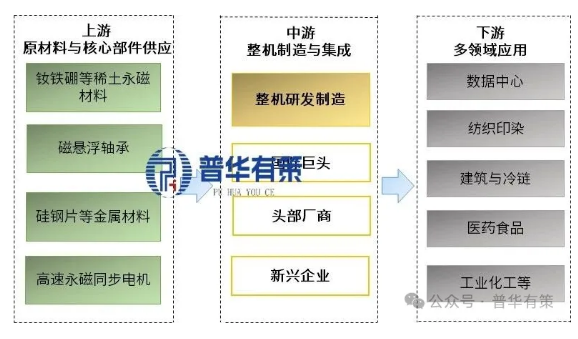

2. Analysis of the Magnetic Levitation Compressor Industry Chain

The magnetic levitation compressor industry chain is divided into three closely related segments: upstream raw material and core component supply, midstream complete machine R&D and manufacturing, and downstream applications in multiple fields. Each segment is supported by representative companies. The upstream segment is based on rare earth permanent magnet materials such as neodymium iron boron, metal materials such as silicon steel sheets, and electronic components. Core components such as magnetic levitation bearings and high-speed permanent magnet synchronous motors account for approximately 40% of the total cost of the machine. Technological barriers are concentrated in material purification and precision manufacturing. Representative companies include Zhongke Sanhuan and Hanbell Precision. The midstream segment is responsible for component integration and performance debugging. The technical challenge lies in the coordinated matching of the motor and compressor. The market presents a competitive landscape between international giants (Danfoss, Siemens, etc.) and domestic companies (Midea, Binglun Environment, MagValley Technology, etc.). Some domestic brands have achieved 100% localization and are approaching international levels in terms of market share and energy efficiency. Downstream demand is expanding due to policies such as "dual carbon" and "Eastern Data, Western Computing". The core application scenario is data centers (accounting for over 50%), while also covering industrial fields (chemical, biomedicine, nuclear power, etc.) and construction and cold chain scenarios. Related companies' products have been widely used in customer scenarios such as Tencent, Alibaba Cloud, and Huawei.

Data centers are a core downstream application area for magnetic levitation compressors (accounting for 50%). Driven by the development of 5G, cloud computing, and artificial intelligence, data centers are expanding in scale and energy consumption issues are becoming more prominent. Magnetic levitation compressor centrifugal chillers still have extremely high energy efficiency under partial load, adaptability to load fluctuations, and the advantages of maintenance-free operation and low downtime risk meet their operational needs. Leading companies such as Tencent and Alibaba have widely adopted them in their newly built large-scale data centers. In addition, the pharmaceutical and food industry (accounting for 25%) uses them in fermentation, refrigeration, and drug storage, ensuring hygiene and safety with their high efficiency and oil-free operation. Other fields such as industrial chemicals and commercial buildings (accounting for a total of 25%) apply them to reaction cooling, central air conditioning systems, and other scenarios, which together constitute the diverse application market of magnetic levitation compressors.

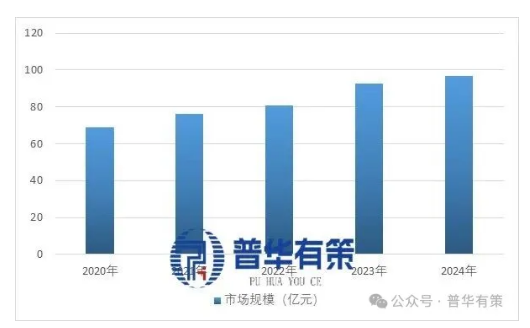

3. Market Size of the Magnetic Levitation Compressor Industry

Driven by the dual-carbon goals, the "East-to-West Data Integration" project, and the demand for AI computing power and data center construction, the magnetic levitation compressor industry is experiencing rapid growth in both the global and Chinese markets. It is projected that by the end of 2025, the Chinese magnetic levitation compressor market size will exceed 9 billion yuan, with a compound annual growth rate (CAGR) of 35%. This growth is primarily driven by the accelerated pace of domestic substitution and the global green and low-carbon transformation. Meanwhile, the Chinese centrifugal compressor market is expected to reach 10.077 billion yuan in 2025, a steady increase from 9.67 billion yuan in 2024. Although the growth rate has slowed, the overall market remains stable.

4. Development Opportunities for the Magnetic Levitation Compressor Industry

(1) Continued Release of Policy Dividends

Domestic policies are increasingly promoting energy-saving equipment. For example, the "Special Action Plan for Green and Low-Carbon Development of Data Centers" requires that by the end of 2025, newly built large data centers should have a PUE of ≤1.25, and national hub nodes ≤1.2. Magnetic levitation compressors, with a COP of 7.0-8.5, offer over 40% energy efficiency improvement compared to traditional models, making them a core choice for data centers to achieve PUE targets. Simultaneously, the first batch of national hub nodes in the "East-West Data Center" project requires 100% adoption of magnetic levitation solutions, coupled with electricity subsidies for low-PUE data centers in first-tier cities, further stimulating market demand. Furthermore, this technology has been included in the "Recommended Catalogue of Energy-Saving Technologies and Equipment," providing policy support for the industry's development.

(2) Explosive Demand Across Multiple Downstream Sectors

Firstly, the data center sector is a core engine. The development of AI computing power has driven the power of single-rack units to jump from 5kW to over 20kW. The penetration rate of liquid cooling technology is rapidly increasing, leading to a surge in demand for magnetic levitation compressors as a core refrigeration component. In 2024, the domestic market size in this sector reached 6.3 billion yuan, and it is projected to increase to 21.81 billion yuan by 2030. Secondly, the industrial sector has huge potential for transformation. There are currently 500,000 to 1 million traditional compressors in China that are over 20 years old. In scenarios with high requirements for cleanliness and energy efficiency, such as pharmaceuticals and food processing, magnetic levitation compressors, due to their oil-free design and energy-saving rate of over 30%, have become a necessity for transformation. Thirdly, demand is growing in sectors such as rail transit and commercial buildings. For example, Shenling Environment's magnetic levitation direct expansion air conditioning solution has been applied to subway lines in more than 20 cities, and Midea's magnetic levitation centrifugal chiller units have surpassed foreign brands in market share in the commercial building sector.

(3) A Golden Window for Domestic Substitution

Previously, foreign brands such as Danfoss monopolized 90% of the domestic market, but domestic equipment quickly broke through with a 30-40% price advantage. By 2024, Danfoss's market share in China had dropped to 60%. Meanwhile, domestic companies continued to make technological breakthroughs. Hanbell Precision Machinery's magnetic levitation centrifuge achieved a COP of 8.3, MagValley Technology led the domestic market in core patents, and Xinlei's products had an energy efficiency ratio exceeding that of foreign brands by 15%. Furthermore, foreign brands face supply bottlenecks; their Jiaxing factory's orders are booked until the first quarter of 2026, with a delivery cycle of 6-8 months. This provides ample time for domestic companies such as Hanbell Precision Machinery and Binglun Environment to seize market share.

(4) Technological Iteration and Scenario Expansion Open Up Growth Space

Technologically, domestic companies have achieved high-speed stable operation at 40,000 rpm. They have also implemented predictive maintenance and intelligent optimization of equipment through the integration of sensors and AI algorithms. Future applications such as new magnetic circuit designs and high-temperature superconducting materials will further enhance product performance. In terms of scenario expansion, the industry is extending from existing fields to emerging fields such as hydrogen energy equipment, semiconductor manufacturing, and nuclear power. For example, magnetic levitation compressors can help improve the overall energy utilization efficiency, adapt to the clean compression requirements in semiconductor manufacturing, and continuously break through market ceilings.

5. Development Trends in the Magnetic Levitation Compressor Industry

(1) Technological Upgrades Towards High Speed and Intelligence, Products Tend to Be Smaller and More Modular

The magnetic levitation compressor industry will focus on breakthroughs in higher performance. Building upon the existing stable operation at 40,000 rpm, it will strive towards 50,000 rpm. Through novel magnetic circuit designs and the application of high-temperature superconducting materials, energy efficiency and adaptability to operating conditions will be improved. The integrated energy efficiency ratio (IPLV) of some high-end models is expected to exceed 10.0. Simultaneously, it will deeply integrate IoT, AI, and digital twin technologies, utilizing high-precision sensors and intelligent algorithms to achieve real-time equipment monitoring, predictive maintenance, and intelligent optimization, extending fault-free operation time. Product form will be optimized towards miniaturization and modularization, meeting the needs of space-constrained scenarios such as semiconductor cleanrooms, while also reducing production and maintenance costs through modular assembly, adapting to customers' personalized needs.

(2) Accelerated Domestic Substitution, Market Competition Focuses on Full Lifecycle Services

The process of domestic substitution will continue to accelerate. Previously, foreign brands such as Danfoss held a 60% share of the domestic high-end market. Meanwhile, domestic companies such as Gree, Haier, and Shaanxi Blower have achieved breakthroughs in the localization of core components (magnetic levitation controllers, high-speed permanent magnet motors, etc.), coupled with a 30-40% price advantage, and have already formed competitiveness in the mid-range market. In the future, they are expected to further break the monopoly of foreign companies in the high-end market. Industry competition will shift from competing on single products to competing on system solutions and full lifecycle services. Companies will extend to integrated services such as customized installation, commissioning, remote operation and maintenance, and energy-saving renovations, creating exclusive solutions for scenarios such as data centers and semiconductor factories, and building core competitive barriers.

(3) Application Scenarios Expanding to Emerging Fields, Demand Structure Continuously Optimizing

Application scenarios will exhibit a pattern of "emerging growth + traditional steady growth." Emerging fields such as semiconductor manufacturing, biomedicine, and rail transportation will become core growth points. Among them, the semiconductor industry's demand for oil-free clean compressed air is surging due to improved process precision, and its market share is expected to exceed 35% by 2030. The biomedical industry is driven by increasingly stringent GMP regulations, leading to a continuous increase in the configuration rate of oil-free compressed air systems. Demand in traditional advantageous scenarios is steadily increasing. Data centers, influenced by PUE value control pressures, have a strong demand for large-scale deployment of high-efficiency cooling equipment. The food industry, to ensure production safety, will continue to increase the replacement rate of oil-free magnetic levitation compressors, providing stable demand support.

The "2025-2031 In-Depth Research and Investment Prospect Consulting Report on the Magnetic Levitation Compressor Industry" covers the global and Chinese development overview of the industry, supply and demand data, market size, industrial policies/planning, related technologies, competitive landscape, upstream raw material situation, downstream major application market demand scale and prospects, regional structure, market concentration, key enterprises/players, enterprise market share, industry characteristics, driving factors, market prospect forecast, investment strategies, main barriers to entry, and related risks. Beijing Puhua Youce Information Consulting Co., Ltd. also provides services such as market-specific research projects, industry research reports, supply chain consulting, project feasibility study reports, certification for specialized, refined, and innovative small giant enterprises, market share reports, 15th Five-Year Plan, project post-evaluation reports, business plans, industry maps, industry planning, blue and white papers, certification for national-level manufacturing single champion enterprises, IPO fundraising feasibility studies, and IPO working paper consulting.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.