FAG Bearings Review and Analysis

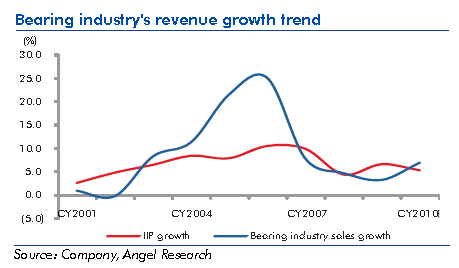

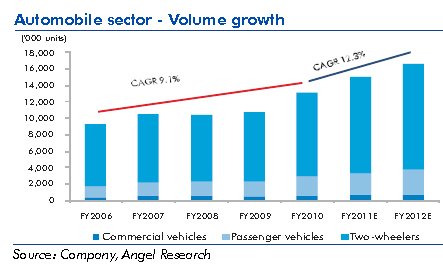

Industry outlook encouraging: We expect a substantial uptick in the industrial segment in the next three-four quarters, driven by higher demand from capital goods companies. The auto segment is also expected to grow, led by a ~12.3% CAGR in auto sector volumes over FY2010-12E. FAG has a strong customer base, including Maruti, M&M, Tata Motors, GM, Ford and Daimler Chrysler, in this segment.

Industry outlook encouraging: We expect a substantial uptick in the industrial segment in the next three-four quarters, driven by higher demand from capital goods companies. The auto segment is also expected to grow, led by a ~12.3% CAGR in auto sector volumes over FY2010-12E. FAG has a strong customer base, including Maruti, M&M, Tata Motors, GM, Ford and Daimler Chrysler, in this segment.

Strong fundamentals and attractive valuation: FAG's net asset turnover remains high (over ~6x in CY2010E) due to largely depreciated assets. The company's strong business model enables it to record robust and consistent RoCE of 30-33%. Cash flow generation is also expected to remain healthy. On the valuation front, the stock is attractively priced at 9.4x CY2012E EPS vs. peer average of 12x CY2012E EPS. We maintain Buy on the stock with a Target Price of Rs.1,035, valuing the stock at 12x CY2012E earnings.

Strong fundamentals and attractive valuation: FAG's net asset turnover remains high (over ~6x in CY2010E) due to largely depreciated assets. The company's strong business model enables it to record robust and consistent RoCE of 30-33%. Cash flow generation is also expected to remain healthy. On the valuation front, the stock is attractively priced at 9.4x CY2012E EPS vs. peer average of 12x CY2012E EPS. We maintain Buy on the stock with a Target Price of Rs.1,035, valuing the stock at 12x CY2012E earnings.

Key risks to our call include: 1) Lower demand and a substantial increase in steel prices, which can exert pressure on margins, 2) adverse currency movement, which can impact FAG's trading business and 3) cheap imports from China.

Key risks to our call include: 1) Lower demand and a substantial increase in steel prices, which can exert pressure on margins, 2) adverse currency movement, which can impact FAG's trading business and 3) cheap imports from China.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next ZKL Group wishes to all partners Merry Christmas and a Happy New Year (pic)

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.