EnPro Industries Announces Third Quarter 2011 Results

Sales in the Sealing Products segment improved by 75% over the third quarter of 2010. Acquisitions contributed $41.7 million to the segment's sales and accounted for 51 points of the segment's sales growth. Organic growth in the segment's core markets accounted for 21 points of the year-over-year improvement in sales while three points came from favorable foreign exchange. The segment's profits improved by 45% as all businesses in the segment reported increases and acquisitions made a contribution, but segment margins declined, primarily because of investments related to sales growth and moderately higher material costs, as well as acquisition-related expenses. Product mix also contributed to the decline in margins as both Stemco and the Technetics Group pursue growth strategies aligned with deeper penetration of original equipment markets.

Engineered Products Segment

Sales in the Sealing Products segment improved by 75% over the third quarter of 2010. Acquisitions contributed $41.7 million to the segment's sales and accounted for 51 points of the segment's sales growth. Organic growth in the segment's core markets accounted for 21 points of the year-over-year improvement in sales while three points came from favorable foreign exchange. The segment's profits improved by 45% as all businesses in the segment reported increases and acquisitions made a contribution, but segment margins declined, primarily because of investments related to sales growth and moderately higher material costs, as well as acquisition-related expenses. Product mix also contributed to the decline in margins as both Stemco and the Technetics Group pursue growth strategies aligned with deeper penetration of original equipment markets.

Engineered Products Segment

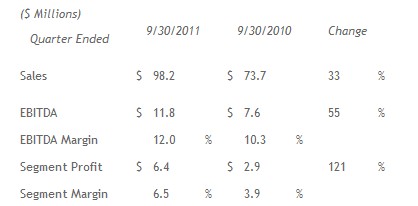

In the Engineered Products segment, sales improved by 33% over the third quarter of 2010. Sales grew 14 points or $10.1 million from acquisitions, organic improvements in the segment's markets contributed 12 points of growth and favorable foreign exchange created seven points of growth. Segment profits more than doubled and profit margins improved as both GGB and CPI benefited from increased volumes and improved pricing compared to a year ago; acquisitions did not make a contribution to segment profits in the quarter.

Engine Products and Services Segment

In the Engineered Products segment, sales improved by 33% over the third quarter of 2010. Sales grew 14 points or $10.1 million from acquisitions, organic improvements in the segment's markets contributed 12 points of growth and favorable foreign exchange created seven points of growth. Segment profits more than doubled and profit margins improved as both GGB and CPI benefited from increased volumes and improved pricing compared to a year ago; acquisitions did not make a contribution to segment profits in the quarter.

Engine Products and Services Segment

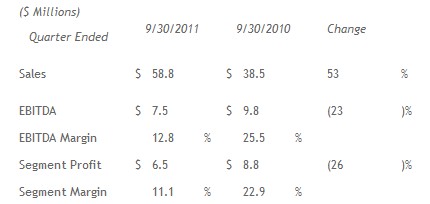

In the third quarter of 2011, Engine Products and Services segment sales increased 53% over the third quarter of 2010. Sales benefited from higher engine shipments and the transition to percentage of completion accounting on new engine contracts, but those benefits were partially offset by lower sales of aftermarket parts and services. Fairbanks Morse Engine shipped six engines in the third quarter of 2011 compared with one engine in the third quarter of 2010 and recognized sales of $3.3 million as a result of percentage of completion in accounting. However, parts and service sales declined significantly from the third quarter of 2010, when repairs to engines on a class of U.S. Navy ships created unusually strong aftermarket demand.

The segment's profits and profit margins were affected by a shift in the product mix to lower margin engine sales as well as by the combined effect of several items. These included a warranty provision for an issue related to engines supplied to a U.S. Navy shipbuilding program over the past several years; a loss provision on a contract related to Fairbanks Morse's nuclear power strategy, including investments made to sustain FME's position in the nuclear power generation market prior to the Fukushima disaster; and reimbursement of costs upon the cancellation of the South Texas Nuclear Project. The net reduction to segment income from these items was $2.1 million.

Garlock Sealing Technologies

In the third quarter of 2011, Engine Products and Services segment sales increased 53% over the third quarter of 2010. Sales benefited from higher engine shipments and the transition to percentage of completion accounting on new engine contracts, but those benefits were partially offset by lower sales of aftermarket parts and services. Fairbanks Morse Engine shipped six engines in the third quarter of 2011 compared with one engine in the third quarter of 2010 and recognized sales of $3.3 million as a result of percentage of completion in accounting. However, parts and service sales declined significantly from the third quarter of 2010, when repairs to engines on a class of U.S. Navy ships created unusually strong aftermarket demand.

The segment's profits and profit margins were affected by a shift in the product mix to lower margin engine sales as well as by the combined effect of several items. These included a warranty provision for an issue related to engines supplied to a U.S. Navy shipbuilding program over the past several years; a loss provision on a contract related to Fairbanks Morse's nuclear power strategy, including investments made to sustain FME's position in the nuclear power generation market prior to the Fukushima disaster; and reimbursement of costs upon the cancellation of the South Texas Nuclear Project. The net reduction to segment income from these items was $2.1 million.

Garlock Sealing Technologies

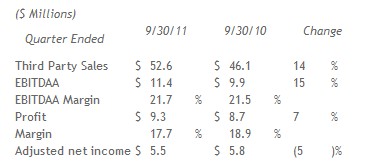

GST and its subsidiaries reported an increase in third party sales of 14% from the third quarter of 2010 as demand grew from industrial markets in the United States. GST's profits improved as volumes increased, but profit margins declined slightly as improvements in pricing only partially offset increases in cost and a $1 million increase to its environmental accrual. Measures of GST's profitability, including adjusted net income, do not reflect expenses of about $3.9 million incurred in connection with the asbestos claims resolution process.

Cash Flows

EnPro's cash balance stood at $22.9 million at September 30, 2011, a reduction of $196.3 million from December 31, 2010. The cash balance at September 30 reflects an investment of $228.2 million to complete acquisitions during 2011. Operating activities generated $32.6 million in cash during the first nine months of 2011 as volumes increased. Operating activities generated cash of $19.1 million in the first nine months of 2010, after net outflows of $3.8 million for asbestos-related claims and expenses. GST completed the first nine months of 2011 with a cash balance of $120.1 million, compared to a balance of $87.1 million at the end of 2010.

Outlook

For the fourth quarter of 2011, EnPro expects sales to improve over the fourth quarter of 2010 as acquisitions completed in 2011 contribute sales of about $50 million. However, sales are also likely to reflect typical fourth quarter seasonality in the Sealing Products and Engineered Products segments and a sequential decrease in engine shipments in the Engine Products and Services segment. The company expects segment profit margins in the fourth quarter to be in line with the levels of the fourth quarter of 2010, reflecting activity levels, acquisition related expenses and the effect of recent acquisitions on the profitability of the company's product mix.

"We have made significant progress towards our long-term goals so far in 2011," said Macadam. "Acquisitions have expanded our presence in very attractive markets, brought us new products and new platforms for growth. We're very excited about where we stand as we enter the last quarter of the year, and we look forward to increasing the benefits we expect to capture from the execution of our strategy in 2012 and beyond."

Conference Call and Webcast Information

EnPro will hold a conference call today, November 3, at 10:00 a.m. Eastern Time to discuss third quarter 2011 results. Investors who wish to participate in the call should dial 1-800-851-4704 approximately 10 minutes before the call begins and provide conference id number 20279705. A live audio webcast of the call and accompanying slide presentation will be accessible from the company's website, http://www.enproindustries.com. To access the presentation, log on to the webcast by clicking the link on the company's home page.

Deconsolidation of Garlock Sealing Technologies

Results for the third quarter and first nine months of 2011 reflect the deconsolidation of Garlock Sealing Technologies LLC (GST) and its subsidiaries, effective June 5, 2010, when GST filed a voluntary petition to begin an asbestos claims resolution process intended to permanently resolve all current and future asbestos claims against it under Section 524(g) of the U.S. Bankruptcy Code. Deconsolidation is required by generally accepted accounting standards, which do not permit the restatement of results of prior periods to reflect the deconsolidation. However, to aid in comparisons of year-over-year data, the company has attached a schedule to this press release showing key operating measures for both EnPro and GST on a pro forma basis. The schedule presents results for the third quarters and first nine months of 2011 and 2010 as if the deconsolidation of GST had occurred on January 1, 2010.

Non-GAAP Financial Information

This press release contains financial measures that have not been prepared in accordance with GAAP. They include income before asbestos-related expenses and other selected items, EBITDAA, EBITDA and related per share amounts. Tables showing the effect of these non-GAAP financial measures for the third quarter and first nine months of 2011 and 2010 are attached to the release.

Forward-Looking Statements

Statements in this press release that express a belief, expectation or intention, as well as those that are not historical fact, are forward-looking statements under the Private Securities Litigation Reform Act of 1995. They involve a number of risks and uncertainties that may cause actual events and results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: general economic conditions in the markets served by our businesses, some of which are cyclical and experience periodic downturns; prices and availability of raw materials; and the amount of any payments required to satisfy contingent liabilities related to discontinued operations of our predecessors, including liabilities for certain products, environmental matters, guaranteed debt payments, employee benefit obligations and other matters. In addition, adverse developments could arise in regard to voluntary petitions filed by certain of our subsidiaries in U.S. Bankruptcy Court to establish a trust that would resolve all current and future asbestos claims. Our filings with the Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2010 and Form 10-Q for the quarter ended June 30, 2010, describe these and other risks and uncertainties in more detail. We do not undertake to update any forward-looking statement made in this press release to reflect any change in management's expectations or any change in the assumptions or circumstances on which such statements are based.

About EnPro Industries

EnPro Industries, Inc. is a leader in sealing products, metal polymer and filament wound bearings, components and service for reciprocating compressors, diesel and dual-fuel engines and other engineered products for use in critical applications by industries worldwide.

GST and its subsidiaries reported an increase in third party sales of 14% from the third quarter of 2010 as demand grew from industrial markets in the United States. GST's profits improved as volumes increased, but profit margins declined slightly as improvements in pricing only partially offset increases in cost and a $1 million increase to its environmental accrual. Measures of GST's profitability, including adjusted net income, do not reflect expenses of about $3.9 million incurred in connection with the asbestos claims resolution process.

Cash Flows

EnPro's cash balance stood at $22.9 million at September 30, 2011, a reduction of $196.3 million from December 31, 2010. The cash balance at September 30 reflects an investment of $228.2 million to complete acquisitions during 2011. Operating activities generated $32.6 million in cash during the first nine months of 2011 as volumes increased. Operating activities generated cash of $19.1 million in the first nine months of 2010, after net outflows of $3.8 million for asbestos-related claims and expenses. GST completed the first nine months of 2011 with a cash balance of $120.1 million, compared to a balance of $87.1 million at the end of 2010.

Outlook

For the fourth quarter of 2011, EnPro expects sales to improve over the fourth quarter of 2010 as acquisitions completed in 2011 contribute sales of about $50 million. However, sales are also likely to reflect typical fourth quarter seasonality in the Sealing Products and Engineered Products segments and a sequential decrease in engine shipments in the Engine Products and Services segment. The company expects segment profit margins in the fourth quarter to be in line with the levels of the fourth quarter of 2010, reflecting activity levels, acquisition related expenses and the effect of recent acquisitions on the profitability of the company's product mix.

"We have made significant progress towards our long-term goals so far in 2011," said Macadam. "Acquisitions have expanded our presence in very attractive markets, brought us new products and new platforms for growth. We're very excited about where we stand as we enter the last quarter of the year, and we look forward to increasing the benefits we expect to capture from the execution of our strategy in 2012 and beyond."

Conference Call and Webcast Information

EnPro will hold a conference call today, November 3, at 10:00 a.m. Eastern Time to discuss third quarter 2011 results. Investors who wish to participate in the call should dial 1-800-851-4704 approximately 10 minutes before the call begins and provide conference id number 20279705. A live audio webcast of the call and accompanying slide presentation will be accessible from the company's website, http://www.enproindustries.com. To access the presentation, log on to the webcast by clicking the link on the company's home page.

Deconsolidation of Garlock Sealing Technologies

Results for the third quarter and first nine months of 2011 reflect the deconsolidation of Garlock Sealing Technologies LLC (GST) and its subsidiaries, effective June 5, 2010, when GST filed a voluntary petition to begin an asbestos claims resolution process intended to permanently resolve all current and future asbestos claims against it under Section 524(g) of the U.S. Bankruptcy Code. Deconsolidation is required by generally accepted accounting standards, which do not permit the restatement of results of prior periods to reflect the deconsolidation. However, to aid in comparisons of year-over-year data, the company has attached a schedule to this press release showing key operating measures for both EnPro and GST on a pro forma basis. The schedule presents results for the third quarters and first nine months of 2011 and 2010 as if the deconsolidation of GST had occurred on January 1, 2010.

Non-GAAP Financial Information

This press release contains financial measures that have not been prepared in accordance with GAAP. They include income before asbestos-related expenses and other selected items, EBITDAA, EBITDA and related per share amounts. Tables showing the effect of these non-GAAP financial measures for the third quarter and first nine months of 2011 and 2010 are attached to the release.

Forward-Looking Statements

Statements in this press release that express a belief, expectation or intention, as well as those that are not historical fact, are forward-looking statements under the Private Securities Litigation Reform Act of 1995. They involve a number of risks and uncertainties that may cause actual events and results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: general economic conditions in the markets served by our businesses, some of which are cyclical and experience periodic downturns; prices and availability of raw materials; and the amount of any payments required to satisfy contingent liabilities related to discontinued operations of our predecessors, including liabilities for certain products, environmental matters, guaranteed debt payments, employee benefit obligations and other matters. In addition, adverse developments could arise in regard to voluntary petitions filed by certain of our subsidiaries in U.S. Bankruptcy Court to establish a trust that would resolve all current and future asbestos claims. Our filings with the Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2010 and Form 10-Q for the quarter ended June 30, 2010, describe these and other risks and uncertainties in more detail. We do not undertake to update any forward-looking statement made in this press release to reflect any change in management's expectations or any change in the assumptions or circumstances on which such statements are based.

About EnPro Industries

EnPro Industries, Inc. is a leader in sealing products, metal polymer and filament wound bearings, components and service for reciprocating compressors, diesel and dual-fuel engines and other engineered products for use in critical applications by industries worldwide.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Development of “Monodrive Two-way Feeder with The Separation Mechanism for Tangled Springs”

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.