NN, Inc. Reports Record Earnings For 2012 First Quarter

Resource from: NN, Inc. Likes:3014

May 08,2012

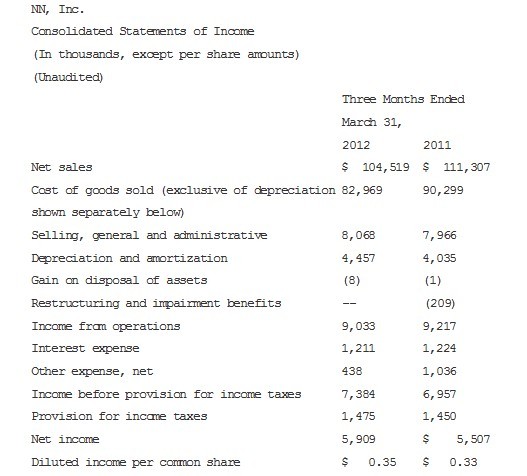

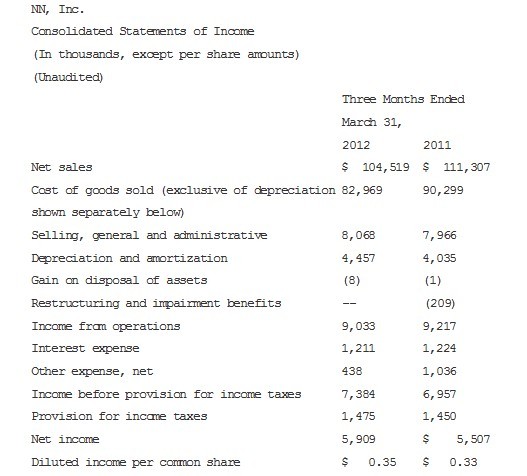

-- Revenues of $104.5 million for the quarter down 6.1% from the first quarter of 2011, due to lower European demand -- Record net income from normal operations of $6.6 million, or $0.39 per diluted share for the quarter, up 20% over $5.5 million, or $0.33 per diluted share from the same period in 2011

On May 7, 2012, NN, Inc. reported its financial results for the first quarter ended March 31, 2012. Net sales for the first quarter of 2012 decreased $6.8 million or 6.1% to $104.5 million, compared to $111.3 million for the same period of 2011. The decrease was due primarily to lower demand for the Company's products in European automotive end markets. Price increases and positive raw material pass through of approximately $1.8 million were offset by the negative impact of foreign currency exchange of approximately $1.7 million.

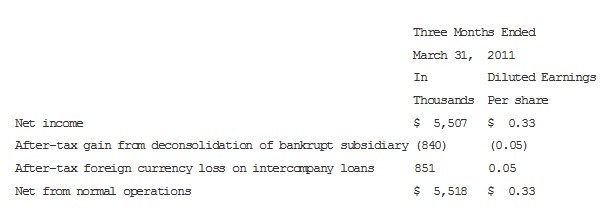

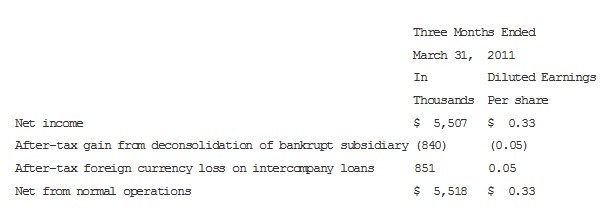

Net income for the first quarter of 2012 of $5.9 million, or $0.35 per diluted share, compares to $5.5 million, or $0.33 per diluted share, for the same period last year. The negative impact of decreased volumes associated with European automotive sales was more than offset by better financial performance from the Precision Metal Components Segment. Net income for this segment for the first quarter of 2012 was $1.6 million as compared to a net loss of $2.2 million for the same period in 2011. Net income from normal operations in the first quarter of 2012 was $6.6 million, or $0.39 per diluted share, compared to net income from normal operations in the first quarter of 2011 of $5.5 million, or $0.33 per diluted share. Net income from normal operations for the first quarter of 2012 excluded the recording of after-tax foreign currency losses on intercompany loans of $0.7 million. Net income from normal operations for the first quarter of 2011 excluded the recording of an after-tax gain from the deconsolidation of our German subsidiary of $0.8 million and the recording of after-tax foreign currency losses on intercompany loans of $0.9 million.

As a percentage of net sales, cost of goods sold for the quarter decreased to 79.4% from 81.1% for last year's first quarter. The reduction was primarily due to improved performance and profitability of the Whirlaway operation and to good performance during the quarter on company-wide cost reductions initiated as part of the ongoing Level 3 continuous improvement program. Additionally, specifically in Europe, the Company was able to further leverage reductions in costs that allowed for good levels of profitability given significantly lower revenues experienced during the quarter.

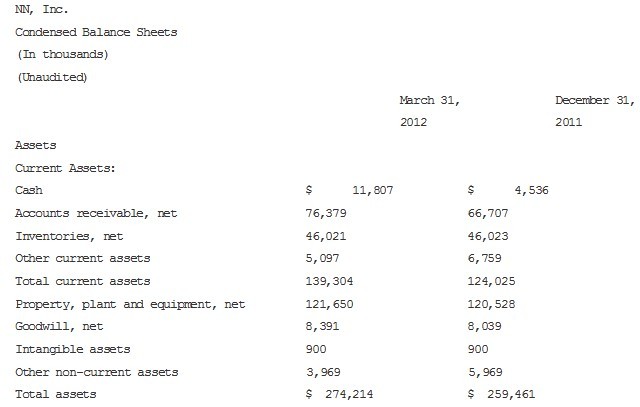

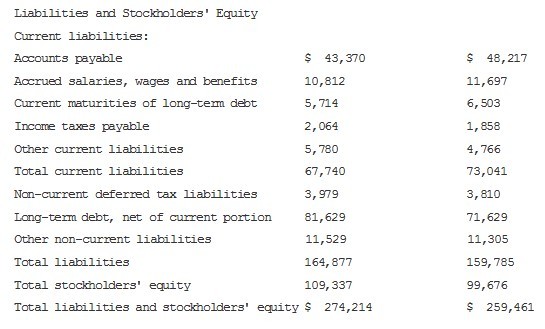

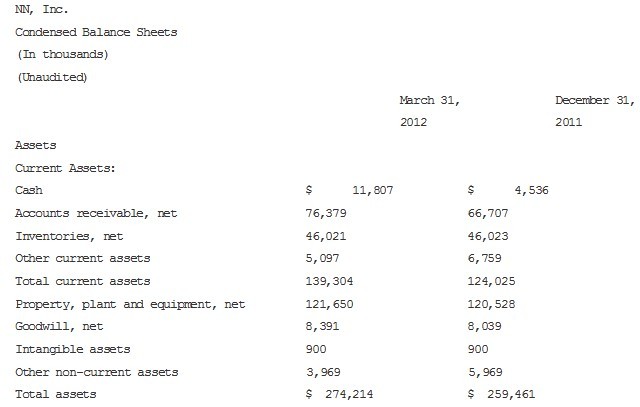

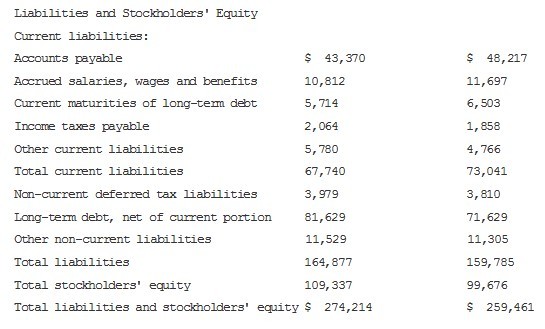

Debt, net of cash, was $75.5 million at March 31, 2012, an increase of $1.9 million over the December 31, 2011 amount of $73.6 million. The increase in net debt for the first quarter was due to an increase in working capital. The timing of collections as well as the timing of the payment of account payable balances relative to the end of the year also contributed to the increase in net debt. This situation is typical of the first quarter historically and the Company expects to meet the beginning of the year goals for debt retirement of approximately $20 million for the year.

Roderick R. Baty, Chairman and Chief Executive Officer commented, "Expected weak demand in Europe due to economic conditions prevailing in European automotive end markets negatively impacted what was otherwise a very strong quarter. Accordingly, we will continue to monitor revenue and demand trends and adjust the costs in our European operations as needed."

Mr. Baty continued, "We are pleased with the continued operational improvements in our Precision Metal Components-Whirlaway business unit. Throughout 2011 and into 2012, we have made quarter over quarter improvements in start-up costs and operational issues which resulted in the recording of $1.6 million in net income at Whirlaway for the first quarter. This turnaround represents a $3.8 million positive swing in profitability compared to the first quarter of 2011. The improved performance at Whirlaway along with solid operational performance at our Metal Bearing and Plastic and Rubber segments are expected to continue through 2012. Additionally, we are bringing more capacity on-line at our operation in China which has resulted in new awards of business from our customers."

Mr. Baty concluded, "We confirm our forecast revenues for the year to be in the $415 - $425 million range, which is relatively consistent with our 2011 revenues of $425 million. However, due to major improvements in profitability at Whirlaway and solid operating performance at our Metal Bearing and Plastic and Rubber Components business units, we are anticipating improvement in margins, net income and EPS for 2012 in comparison to 2011."

NN, Inc. manufacturers and supplies high precision metal bearing components, industrial plastic and rubber products and precision metal components to a variety of markets on a global basis. Headquartered in Johnson City, Tennessee, NN has 10 manufacturing plants in the United States, Western Europe, Eastern Europe and China. NN, Inc. had sales of US $425 million in 2011.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These, and similar statements, are forward-looking statements concerning matters that involve risks, uncertainties and other factors which may cause the actual performance of NN, Inc. and its subsidiaries to differ materially from those expressed or implied by this discussion. All forward-looking information is provided by the Company pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of these factors. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "assumptions", "target", "guidance", "outlook", "plans", "projection", "may", "will", "would", "expect", "intend", "estimate", "anticipate", "believe", "potential" or "continue" (or the negative or other derivatives of each of these terms) or similar terminology. Factors which could materially affect actual results include, but are not limited to: general economic conditions and economic conditions in the industrial sector, inventory levels, regulatory compliance costs and the Company's ability to manage these costs, start-up costs for new operations, debt reduction, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability and price of raw materials, currency and other risks associated with international trade, the Company's dependence on certain major customers, the successful implementation of the global growth plan including development of new products and consummation of potential acquisitions and other risk factors and cautionary statements listed from time to time in the Company's periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

Financial Tables Follow

The Company's management evaluates operating performance excluding unusual and/or nonrecurring items. The Company believes excluding such items provides a more effective and comparable measure of performance and a clearer view of underlying trends. Since net income excluding these items is not a measure calculated in accordance with GAAP, this should not be considered as a substitute for other GAAP measures, including net income, as an indicator of performance. Accordingly, net income/loss excluding the above items is reconciled to net income/loss on a GAAP basis.

The Company's management evaluates operating performance excluding unusual and/or nonrecurring items. The Company believes excluding such items provides a more effective and comparable measure of performance and a clearer view of underlying trends. Since net income excluding these items is not a measure calculated in accordance with GAAP, this should not be considered as a substitute for other GAAP measures, including net income, as an indicator of performance. Accordingly, net income/loss excluding the above items is reconciled to net income/loss on a GAAP basis.

(NN, Inc.)

【CBCC News Statement】

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.

The Company's management evaluates operating performance excluding unusual and/or nonrecurring items. The Company believes excluding such items provides a more effective and comparable measure of performance and a clearer view of underlying trends. Since net income excluding these items is not a measure calculated in accordance with GAAP, this should not be considered as a substitute for other GAAP measures, including net income, as an indicator of performance. Accordingly, net income/loss excluding the above items is reconciled to net income/loss on a GAAP basis.

The Company's management evaluates operating performance excluding unusual and/or nonrecurring items. The Company believes excluding such items provides a more effective and comparable measure of performance and a clearer view of underlying trends. Since net income excluding these items is not a measure calculated in accordance with GAAP, this should not be considered as a substitute for other GAAP measures, including net income, as an indicator of performance. Accordingly, net income/loss excluding the above items is reconciled to net income/loss on a GAAP basis.