RBC Bearings Incorporated Announces Fiscal 2012 Fourth Quarter Results

“Our fourth quarter results demonstrated our continued strong execution and the improving fundamentals of our end markets. Strong demand in the industrial end markets, particularly mining, energy, and general distribution, continues, and our major aerospace customers are increasing build rates that incorporate numerous new products,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “We are pleased to report growth in sales, gross margins, and earnings for our fiscal year, and we remain focused on delivering shareholder value as we execute on our plans to position RBC Bearings as a leading manufacturer for the industrial and aerospace markets.”

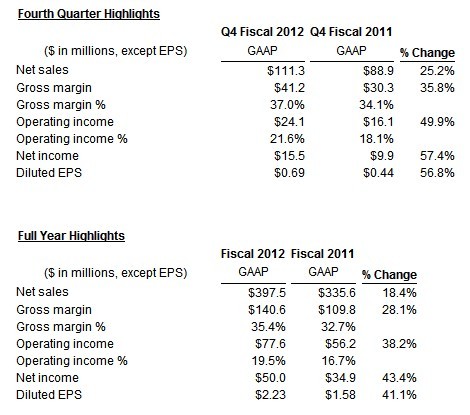

Fourth Quarter Results

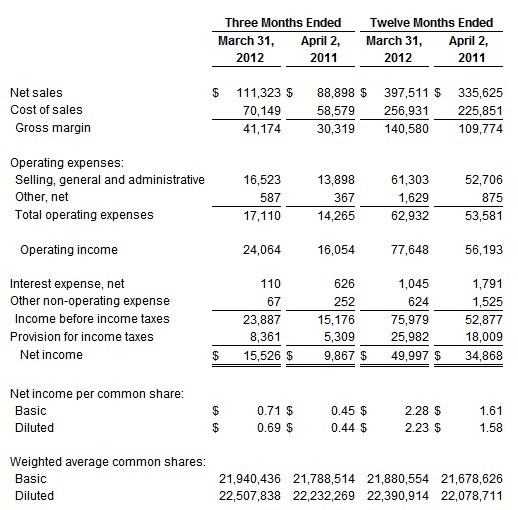

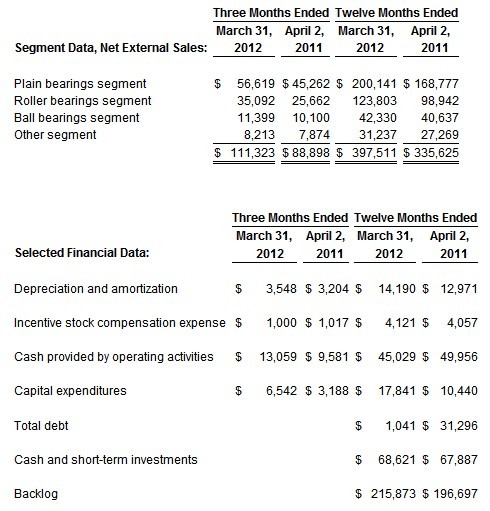

Net sales for the fourth quarter of fiscal 2012 were $111.3 million, an increase of 25.2% from $88.9 million in the fourth quarter of fiscal 2011. The increase of 25.2% was driven by an increase of 25.4% in our industrial business and by a 25.0% increase in net sales in our aerospace and defense business. Gross margin for the fourth quarter was $41.2 million compared to $30.3 million for the same period last year. Gross margin as a percentage of net sales was 37.0% in the fourth quarter of fiscal 2012 compared to 34.1% for the same period last year.

Operating income increased 49.9% to $24.1 million for the fourth quarter of fiscal 2012 compared to $16.1 million for the same period last year. As a percentage of net sales, operating income was 21.6% compared to 18.1% for the same period last year.

Interest expense, net for the fourth quarter of fiscal 2012 was $0.1 million compared to $0.6 million for the same period last year.

Income tax expense for the fourth quarter of fiscal 2012 was $8.4 million, an effective income tax rate of 35.0% compared to income tax expense of $5.3 million, an effective rate of 35.0% for the same period last year.

For the fourth quarter of fiscal 2012, the Company reported net income of $15.5 million compared to net income of $9.9 million in the same period last year. Diluted EPS for the fourth quarter of fiscal 2012 increased 56.8% to $0.69 per share compared to $0.44 per share for the same period last year.

Full Year Results

Net sales for the twelve month period ended March 31, 2012 were $397.5 million, an increase of 18.4% from $335.6 million for the twelve month period ended April 2, 2011. Both our industrial and aerospace and defense markets contributed equally to this increase in net sales. Gross margin for the twelve month period ended March 31, 2012 was $140.6 million compared to $109.8 million for the same period last year. Gross margin as a percentage of net sales was 35.4% for the twelve month period of fiscal 2012 compared to 32.7% for the same period last year.

For the twelve month period ended March 31, 2012, the Company reported operating income of $77.6 million compared to $56.2 million for the same period last year. Operating income as a percentage of net sales was 19.5% for the twelve month period ended March 31, 2012 compared to 16.7% for the same period last year.

Interest expense, net for the twelve month period ended March 31, 2012 was $1.0 million, a decrease of $0.8 million, from $1.8 million for the same period last year.

Income tax expense for the twelve month period ended March 31, 2012 was $26.0 million, an effective income tax rate of 34.2% compared to income tax expense of $18.0 million, an effective income tax rate of 34.1%, for the same period last year.

Net income for the twelve month period ended March 31, 2012 was $50.0 million compared to net income of $34.9 million for the same period last year. Diluted EPS for the twelve months ended March 31, 2012 was $2.23 per share compared to $1.58 per share for the same period last year.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 800-561-2693 (international callers dial 617-614-3523) and enter conference ID # 12074078. An audio replay of the call will be available from 1:00 p.m. ET on Wednesday, May 30th until 11:59 p.m. ET on Wednesday, June 6th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 88390174. Investors are advised to dial into the call at least ten minutes prior to the call to register.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,137 people and operates 23 manufacturing facilities in four countries.

Safe Harbor for Forward Looking Statements

Certain statements in this press release contain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including the section of this press release entitled “Outlook”; any projections of earnings, revenue or other financial items relating to the Company, any statement of the plans, strategies and objectives of management for future operations; any statements concerning proposed future growth rates in the markets we serve; any statements of belief; any characterization of and the Company’s ability to control contingent liabilities; anticipated trends in the Company’s businesses; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate” and other similar words. Although the Company believes that the expectations reflected in any forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties beyond the control of the Company. These risks and uncertainties include, but are not limited to, risks and uncertainties relating to general economic conditions, geopolitical factors, future levels of general industrial manufacturing activity, future financial performance, market acceptance of new or enhanced versions of the Company’s products, the pricing of raw materials, changes in the competitive environments in which the Company’s businesses operate, the outcome of pending or future litigation and governmental proceedings and approvals, estimated legal costs, increases in interest rates, the Company’s ability to meet its debt obligations, and risks and uncertainties listed or disclosed in the Company’s reports filed with the Securities and Exchange Commission, including, without limitation, the risks identified under the heading “Risk Factors” set forth in the Company’s Annual Report filed on Form 10-K. The Company does not intend, and undertakes no obligation, to update or alter any forward-looking statement.

RBC Bearings Incorporated

Consolidated Statements of Operations

(dollars in thousands, except share and per share data)

(Unaudited)

“Our fourth quarter results demonstrated our continued strong execution and the improving fundamentals of our end markets. Strong demand in the industrial end markets, particularly mining, energy, and general distribution, continues, and our major aerospace customers are increasing build rates that incorporate numerous new products,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “We are pleased to report growth in sales, gross margins, and earnings for our fiscal year, and we remain focused on delivering shareholder value as we execute on our plans to position RBC Bearings as a leading manufacturer for the industrial and aerospace markets.”

Fourth Quarter Results

Net sales for the fourth quarter of fiscal 2012 were $111.3 million, an increase of 25.2% from $88.9 million in the fourth quarter of fiscal 2011. The increase of 25.2% was driven by an increase of 25.4% in our industrial business and by a 25.0% increase in net sales in our aerospace and defense business. Gross margin for the fourth quarter was $41.2 million compared to $30.3 million for the same period last year. Gross margin as a percentage of net sales was 37.0% in the fourth quarter of fiscal 2012 compared to 34.1% for the same period last year.

Operating income increased 49.9% to $24.1 million for the fourth quarter of fiscal 2012 compared to $16.1 million for the same period last year. As a percentage of net sales, operating income was 21.6% compared to 18.1% for the same period last year.

Interest expense, net for the fourth quarter of fiscal 2012 was $0.1 million compared to $0.6 million for the same period last year.

Income tax expense for the fourth quarter of fiscal 2012 was $8.4 million, an effective income tax rate of 35.0% compared to income tax expense of $5.3 million, an effective rate of 35.0% for the same period last year.

For the fourth quarter of fiscal 2012, the Company reported net income of $15.5 million compared to net income of $9.9 million in the same period last year. Diluted EPS for the fourth quarter of fiscal 2012 increased 56.8% to $0.69 per share compared to $0.44 per share for the same period last year.

Full Year Results

Net sales for the twelve month period ended March 31, 2012 were $397.5 million, an increase of 18.4% from $335.6 million for the twelve month period ended April 2, 2011. Both our industrial and aerospace and defense markets contributed equally to this increase in net sales. Gross margin for the twelve month period ended March 31, 2012 was $140.6 million compared to $109.8 million for the same period last year. Gross margin as a percentage of net sales was 35.4% for the twelve month period of fiscal 2012 compared to 32.7% for the same period last year.

For the twelve month period ended March 31, 2012, the Company reported operating income of $77.6 million compared to $56.2 million for the same period last year. Operating income as a percentage of net sales was 19.5% for the twelve month period ended March 31, 2012 compared to 16.7% for the same period last year.

Interest expense, net for the twelve month period ended March 31, 2012 was $1.0 million, a decrease of $0.8 million, from $1.8 million for the same period last year.

Income tax expense for the twelve month period ended March 31, 2012 was $26.0 million, an effective income tax rate of 34.2% compared to income tax expense of $18.0 million, an effective income tax rate of 34.1%, for the same period last year.

Net income for the twelve month period ended March 31, 2012 was $50.0 million compared to net income of $34.9 million for the same period last year. Diluted EPS for the twelve months ended March 31, 2012 was $2.23 per share compared to $1.58 per share for the same period last year.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 800-561-2693 (international callers dial 617-614-3523) and enter conference ID # 12074078. An audio replay of the call will be available from 1:00 p.m. ET on Wednesday, May 30th until 11:59 p.m. ET on Wednesday, June 6th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 88390174. Investors are advised to dial into the call at least ten minutes prior to the call to register.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,137 people and operates 23 manufacturing facilities in four countries.

Safe Harbor for Forward Looking Statements

Certain statements in this press release contain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including the section of this press release entitled “Outlook”; any projections of earnings, revenue or other financial items relating to the Company, any statement of the plans, strategies and objectives of management for future operations; any statements concerning proposed future growth rates in the markets we serve; any statements of belief; any characterization of and the Company’s ability to control contingent liabilities; anticipated trends in the Company’s businesses; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate” and other similar words. Although the Company believes that the expectations reflected in any forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties beyond the control of the Company. These risks and uncertainties include, but are not limited to, risks and uncertainties relating to general economic conditions, geopolitical factors, future levels of general industrial manufacturing activity, future financial performance, market acceptance of new or enhanced versions of the Company’s products, the pricing of raw materials, changes in the competitive environments in which the Company’s businesses operate, the outcome of pending or future litigation and governmental proceedings and approvals, estimated legal costs, increases in interest rates, the Company’s ability to meet its debt obligations, and risks and uncertainties listed or disclosed in the Company’s reports filed with the Securities and Exchange Commission, including, without limitation, the risks identified under the heading “Risk Factors” set forth in the Company’s Annual Report filed on Form 10-K. The Company does not intend, and undertakes no obligation, to update or alter any forward-looking statement.

RBC Bearings Incorporated

Consolidated Statements of Operations

(dollars in thousands, except share and per share data)

(Unaudited)

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next Launching of SKF Enduro Steering Race

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.