Timken Reports Second Quarter Results

"Our second-quarter performance demonstrated the impact of our improved business model and operating capabilities," said James W. Griffith, Timken president and chief executive officer. "As the quarter unfolded, it became clear that the weakening global economy was reducing demand for our products and services. We adjusted our business to the economic realities and are confident Timken is positioned to perform well through the economic cycle."

Among recent developments, the company:

•Received $109.5 million, pre-tax, in distributions under CDSOA from amounts previously withheld for anti-dumping cases;

•Announced plans to close its St. Thomas, Ontario, bearing plant and consolidate operations into existing U.S. facilities, which the company anticipates will generate future cost savings;

•Declared and paid a quarterly cash dividend of $0.23 per share, marking 90 years of paying consecutive quarterly dividends since the company was listed on the NYSE in 1922; and

•Received the Polk Inventory Efficiency Award which recognized the automotive aftermarket business for improved inventory planning, shipping performance, fill rates and customer satisfaction.

Six Months' Results

Timken posted sales of $2.8 billion in the first half of 2012, up 7 percent from the same period in 2011. The increase primarily reflects the favorable impact of acquisitions, pricing and mix, which were partially offset by lower sales volume and the impact of currency.

In the first half of 2012, the company generated income of $339.3 million, or $3.44 per diluted share. That compares with $234.2 million, or $2.36 per diluted share, earned in the same period last year. Earnings during the first half of 2012 benefited from CDSOA receipts, pricing and mix, and acquisitions, which were partially offset by lower volume, plant closure charges and higher selling and administrative expenses.

Total debt as of June 30, 2012, was $494.2 million, or 17.6 percent of capital. The company had cash of $509.9 million, or $15.7 million in excess of total debt, at the end of the second quarter. This compares with a net debt position of $46.7 million at the end of 2011.

In the first half of 2012, the company generated $236.4 million in cash from operating activities with strong earnings and CDSOA receipts partially offset by discretionary pension contributions and higher working capital required to support demand. Excluding discretionary pension contributions of $203.8 million, net of tax, and the benefit of CDSOA receipts, free cash flow (operating cash after capital expenditures and dividends) was $139.2 million. The company continues to maintain a strong balance sheet and ended the quarter with $1.4 billion of available liquidity.

Mobile Industries Segment Results

In the second quarter, Mobile Industries' sales were $448.4 million, down 4 percent from last year's second-quarter sales of $465.2 million. The benefit of the Drives acquisition and the strength of rail markets were more than offset by lower demand in other mobile sectors and currency.

EBIT for the segment was $48.8 million for the second quarter, or 10.9 percent of sales. This represents a 32 percent decrease from $71.4 million, or 15.3 percent of sales, in the same period a year ago and was primarily driven by lower volume and $17.4 million of charges related to the closure of the St. Thomas plant.

For the first half of 2012, Mobile Industries' sales rose slightly to $917.5 million relative to the same period a year ago. First-half 2012 EBIT was $135.5 million, or 14.8 percent of sales, compared with $143.5 million, or 15.8 percent of sales, during the same period in the prior year.

Process Industries Segment Results

Process Industries' second-quarter sales were $337.7 million, up 10 percent from $308.3 million for the same period a year ago. The increase reflects the impact of acquisitions and pricing, partially offset by weaker demand outside North America, as well as currency.

The segment's second-quarter EBIT was $71.3 million, or 21.1 percent of sales, up 4 percent from $68.7 million, or 22.3 percent of sales, for the same period a year ago. Pricing and acquisitions led to the increase, partially offset by lower volume and currency.

For the first half of 2012, Process Industries' sales were $693.3 million, up 17 percent from the same period a year ago. First-half 2012 EBIT was $153.6 million, or 22.2 percent of sales, up from the prior year's first-half EBIT of $134 million, or 22.6 percent of sales.

Aerospace and Defense Segment Results

Aerospace and Defense had second-quarter sales of $87.2 million, up 4 percent from $83.5 million for the same period last year. The increase reflects higher volume, led by the defense and motion control sectors.

Second-quarter EBIT was $7.9 million, or 9.1 percent of sales, up from $2.5 million, or 3 percent of sales, for the same period a year ago, reflecting higher volume. The prior year also included a $3 million inventory write-down.

For the first half of 2012, Aerospace and Defense sales were $178.5 million, up 10 percent from the same period a year ago. First-half 2012 EBIT was $18.6 million, or 10.4 percent of sales, compared with EBIT of $4.1 million, or 2.5 percent of sales, in the first half of 2011.

Steel Segment Results

Sales for Steel, including inter-segment sales, were $499.8 million in the second quarter, down slightly from $505.1 million for the same period last year. The results reflect increased pricing and favorable mix, offset by lower shipments to the industrial and mobile on-highway sectors and lower material surcharges of approximately $30 million compared to the second quarter last year.

Second-quarter EBIT was $88.9 million, or 17.8 percent of sales, up 25 percent from $71.3 million, or 14.1 percent of sales, for the same period a year ago. EBIT benefited from pricing and lower material costs, partially offset by lower volume and material surcharges.

For the first six months of 2012, Steel segment sales were $1 billion, up 5 percent from the first half of last year. Material surcharges decreased approximately $25 million from the same period a year ago. EBIT for the first half of 2012 was $176.9 million, or 17.1 percent of sales, compared with $130.6 million, or 13.2 percent of sales, for the same period a year ago.

Outlook

The company expects further weakening in many of its global markets for the remainder of 2012. As a result, Timken now expects 2012 sales to be up slightly compared to 2011 with:

•Mobile Industries' sales flat to down 5 percent for the year reflecting improved rail and off-highway demand offset by weaker light vehicle and heavy truck shipments;

•Process Industries' sales up 7 to 12 percent, driven by the full-year impact of acquisitions and industrial distribution demand;

•Aerospace and Defense sales up 10 to 15 percent, driven by increased demand across most end-markets, led by the defense and civil aerospace sectors; and

•Steel sales flat to down 5 percent, driven by lower overall market demand and material surcharges partially offset by improved pricing and mix.

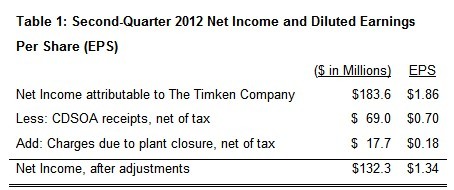

Timken now projects 2012 annual earnings to range from $5.00 to $5.30 per diluted share, which includes the one-time benefit of CDSOA receipts in the second quarter totaling approximately 70 cents per share and the costs associated with the St. Thomas plant closure totaling approximately 30 cents per share.

Timken expects to generate strong cash from operations of approximately $545 million. Free cash flow is still projected to be $140 million after making capital expenditures of about $315 million and paying roughly $90 million in dividends. Excluding discretionary pension and VEBA trust contributions of approximately $220 million, net of tax, and CDSOA receipts of approximately $70 million, net of tax, the company forecasts free cash flow of approximately $290 million in 2012.

Conference Call Information

Timken will host a conference call today at 11:00 a.m. to review its financial results. Presentation materials will be available online in advance of the call for interested investors and securities analysts.

About The Timken Company

The Timken Company (NYSE: TKR; www.timken.com) keeps the world turning with innovative friction management and mechanical power transmission products and services that help machinery perform more efficiently and reliably. With sales of $5.2 billion in 2011 and approximately 21,000 people operating from locations in 30 countries, Timken is Where You Turn® for better performance.

"Our second-quarter performance demonstrated the impact of our improved business model and operating capabilities," said James W. Griffith, Timken president and chief executive officer. "As the quarter unfolded, it became clear that the weakening global economy was reducing demand for our products and services. We adjusted our business to the economic realities and are confident Timken is positioned to perform well through the economic cycle."

Among recent developments, the company:

•Received $109.5 million, pre-tax, in distributions under CDSOA from amounts previously withheld for anti-dumping cases;

•Announced plans to close its St. Thomas, Ontario, bearing plant and consolidate operations into existing U.S. facilities, which the company anticipates will generate future cost savings;

•Declared and paid a quarterly cash dividend of $0.23 per share, marking 90 years of paying consecutive quarterly dividends since the company was listed on the NYSE in 1922; and

•Received the Polk Inventory Efficiency Award which recognized the automotive aftermarket business for improved inventory planning, shipping performance, fill rates and customer satisfaction.

Six Months' Results

Timken posted sales of $2.8 billion in the first half of 2012, up 7 percent from the same period in 2011. The increase primarily reflects the favorable impact of acquisitions, pricing and mix, which were partially offset by lower sales volume and the impact of currency.

In the first half of 2012, the company generated income of $339.3 million, or $3.44 per diluted share. That compares with $234.2 million, or $2.36 per diluted share, earned in the same period last year. Earnings during the first half of 2012 benefited from CDSOA receipts, pricing and mix, and acquisitions, which were partially offset by lower volume, plant closure charges and higher selling and administrative expenses.

Total debt as of June 30, 2012, was $494.2 million, or 17.6 percent of capital. The company had cash of $509.9 million, or $15.7 million in excess of total debt, at the end of the second quarter. This compares with a net debt position of $46.7 million at the end of 2011.

In the first half of 2012, the company generated $236.4 million in cash from operating activities with strong earnings and CDSOA receipts partially offset by discretionary pension contributions and higher working capital required to support demand. Excluding discretionary pension contributions of $203.8 million, net of tax, and the benefit of CDSOA receipts, free cash flow (operating cash after capital expenditures and dividends) was $139.2 million. The company continues to maintain a strong balance sheet and ended the quarter with $1.4 billion of available liquidity.

Mobile Industries Segment Results

In the second quarter, Mobile Industries' sales were $448.4 million, down 4 percent from last year's second-quarter sales of $465.2 million. The benefit of the Drives acquisition and the strength of rail markets were more than offset by lower demand in other mobile sectors and currency.

EBIT for the segment was $48.8 million for the second quarter, or 10.9 percent of sales. This represents a 32 percent decrease from $71.4 million, or 15.3 percent of sales, in the same period a year ago and was primarily driven by lower volume and $17.4 million of charges related to the closure of the St. Thomas plant.

For the first half of 2012, Mobile Industries' sales rose slightly to $917.5 million relative to the same period a year ago. First-half 2012 EBIT was $135.5 million, or 14.8 percent of sales, compared with $143.5 million, or 15.8 percent of sales, during the same period in the prior year.

Process Industries Segment Results

Process Industries' second-quarter sales were $337.7 million, up 10 percent from $308.3 million for the same period a year ago. The increase reflects the impact of acquisitions and pricing, partially offset by weaker demand outside North America, as well as currency.

The segment's second-quarter EBIT was $71.3 million, or 21.1 percent of sales, up 4 percent from $68.7 million, or 22.3 percent of sales, for the same period a year ago. Pricing and acquisitions led to the increase, partially offset by lower volume and currency.

For the first half of 2012, Process Industries' sales were $693.3 million, up 17 percent from the same period a year ago. First-half 2012 EBIT was $153.6 million, or 22.2 percent of sales, up from the prior year's first-half EBIT of $134 million, or 22.6 percent of sales.

Aerospace and Defense Segment Results

Aerospace and Defense had second-quarter sales of $87.2 million, up 4 percent from $83.5 million for the same period last year. The increase reflects higher volume, led by the defense and motion control sectors.

Second-quarter EBIT was $7.9 million, or 9.1 percent of sales, up from $2.5 million, or 3 percent of sales, for the same period a year ago, reflecting higher volume. The prior year also included a $3 million inventory write-down.

For the first half of 2012, Aerospace and Defense sales were $178.5 million, up 10 percent from the same period a year ago. First-half 2012 EBIT was $18.6 million, or 10.4 percent of sales, compared with EBIT of $4.1 million, or 2.5 percent of sales, in the first half of 2011.

Steel Segment Results

Sales for Steel, including inter-segment sales, were $499.8 million in the second quarter, down slightly from $505.1 million for the same period last year. The results reflect increased pricing and favorable mix, offset by lower shipments to the industrial and mobile on-highway sectors and lower material surcharges of approximately $30 million compared to the second quarter last year.

Second-quarter EBIT was $88.9 million, or 17.8 percent of sales, up 25 percent from $71.3 million, or 14.1 percent of sales, for the same period a year ago. EBIT benefited from pricing and lower material costs, partially offset by lower volume and material surcharges.

For the first six months of 2012, Steel segment sales were $1 billion, up 5 percent from the first half of last year. Material surcharges decreased approximately $25 million from the same period a year ago. EBIT for the first half of 2012 was $176.9 million, or 17.1 percent of sales, compared with $130.6 million, or 13.2 percent of sales, for the same period a year ago.

Outlook

The company expects further weakening in many of its global markets for the remainder of 2012. As a result, Timken now expects 2012 sales to be up slightly compared to 2011 with:

•Mobile Industries' sales flat to down 5 percent for the year reflecting improved rail and off-highway demand offset by weaker light vehicle and heavy truck shipments;

•Process Industries' sales up 7 to 12 percent, driven by the full-year impact of acquisitions and industrial distribution demand;

•Aerospace and Defense sales up 10 to 15 percent, driven by increased demand across most end-markets, led by the defense and civil aerospace sectors; and

•Steel sales flat to down 5 percent, driven by lower overall market demand and material surcharges partially offset by improved pricing and mix.

Timken now projects 2012 annual earnings to range from $5.00 to $5.30 per diluted share, which includes the one-time benefit of CDSOA receipts in the second quarter totaling approximately 70 cents per share and the costs associated with the St. Thomas plant closure totaling approximately 30 cents per share.

Timken expects to generate strong cash from operations of approximately $545 million. Free cash flow is still projected to be $140 million after making capital expenditures of about $315 million and paying roughly $90 million in dividends. Excluding discretionary pension and VEBA trust contributions of approximately $220 million, net of tax, and CDSOA receipts of approximately $70 million, net of tax, the company forecasts free cash flow of approximately $290 million in 2012.

Conference Call Information

Timken will host a conference call today at 11:00 a.m. to review its financial results. Presentation materials will be available online in advance of the call for interested investors and securities analysts.

About The Timken Company

The Timken Company (NYSE: TKR; www.timken.com) keeps the world turning with innovative friction management and mechanical power transmission products and services that help machinery perform more efficiently and reliably. With sales of $5.2 billion in 2011 and approximately 21,000 people operating from locations in 30 countries, Timken is Where You Turn® for better performance.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next NSK's New Free Industry Specific Brochure shows Cement producers how to get more bearing life from their plants

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.