RBC Bearings Incorporated Announces Fiscal 2012 Third Quarter Results

“We are pleased with the strong results we reported in our third quarter,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “Strong demand continues across our industrial end markets, specifically mining, oil and gas, and general industrial distribution. We are also seeing an acceleration of production in the aerospace market, and we are reviewing our order book and making the necessary adjustments operationally to ensure that we can continue capitalizing on these opportunities throughout the year.”

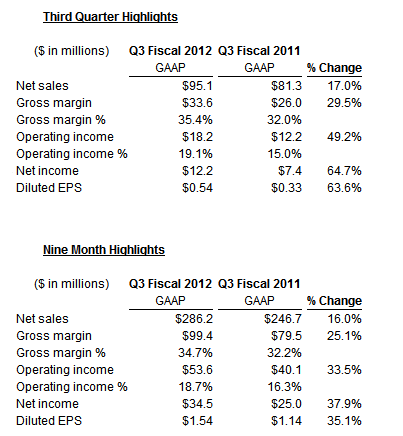

Third Quarter Results

Net sales for the third quarter of fiscal 2012 were $95.1 million, an increase of 17.0% from $81.3 million in the third quarter of fiscal 2011. The increase of 17.0% was driven by an increase of 18.0% in our industrial business and by a 16.1% increase in net sales in our aerospace and defense business. Gross margin for the third quarter was $33.6 million compared to $26.0 million for the same period last year. Gross margin as a percentage of net sales was 35.4% in the third quarter of fiscal 2012 compared to 32.0% for the same period last year.

Operating income increased 49.2% to $18.2 million for the third quarter of fiscal 2012 compared to $12.2 million for the same period last year. As a percentage of net sales, operating income was 19.1% compared to 15.0% for the same period last year.

Interest expense, net for the third quarter of fiscal 2012 was $0.2 million compared to $0.4 million for the same period last year.

Income tax expense for the third quarter of fiscal 2012 was $5.8 million, an effective income tax rate of 32.1% compared to income tax expense of $4.0 million, an effective rate of 35.1% for the same period last year. The effective income tax rate for the third quarter of fiscal 2012 includes $0.4 million in discrete items. The effective income tax rate for the third quarter fiscal 2012 excluding these discrete items would have been 34.5%.

For the third quarter of fiscal 2012, the Company reported net income of $12.2 million compared to net income of $7.4 million in the same period last year. Diluted EPS for the third quarter of fiscal 2012 increased 63.6% to $0.54 per share compared to $0.33 per share for the same period last year.

Nine Month Results

Net sales for the nine month period ended December 31, 2011 were $286.2 million, an increase of 16.0% from $246.7 million for the nine month period ended January 1, 2011. Both our industrial and aerospace and defense markets contributed equally to this increase in net sales. Gross margin for the nine month period ended December 31, 2011 was $99.4 million compared to $79.5 million for the same period last year. Gross margin as a percentage of net sales was 34.7% for the nine month period of fiscal 2012 compared to 32.2% for the same period last year.

For the nine month period ended December 31, 2011, the Company reported operating income of $53.6 million compared to $40.1 million for the same period last year. Operating income as a percentage of net sales was 18.7% for the nine month period ended December 31, 2011 compared to 16.3% for the same period last year.

Interest expense, net for the nine month period ended December 31, 2011 was $0.9 million, a decrease of $0.3 million, from $1.2 million for the same period last year.

Income tax expense for the nine month period ended December 31, 2011 was $17.6 million, an effective income tax rate of 33.8% compared to income tax expense of $12.7 million, an effective income tax rate of 33.7%, for the same period last year. The effective income tax rate for the nine month period for this year and last year include discrete items of $0.4 million and $0.6 million, respectively. Excluding these discrete items, the effective tax rate for the nine months ended December 31, 2011 would have been 34.5% compared to 35.2% for the same nine month period last year.

Net income for the nine month period ended December 31, 2011 was $34.5 million compared to net income of $25.0 million for the same period last year. Diluted EPS for the nine months ended December 31, 2011 was $1.54 per share compared to $1.14 per share for the same period last year.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 866-713-8567 (international callers dial 617-597-5326) and enter conference ID # 20565187. An audio replay of the call will be available from 1:00 p.m. ET on Wednesday, February 8th until 11:59 p.m. ET on Wednesday, February 15th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 92328357. Investors are advised to dial into the call at least ten minutes prior to the call to register.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,086 people and operates 23 manufacturing facilities in four countries.

“We are pleased with the strong results we reported in our third quarter,” said Dr. Michael J. Hartnett, Chairman and Chief Executive Officer. “Strong demand continues across our industrial end markets, specifically mining, oil and gas, and general industrial distribution. We are also seeing an acceleration of production in the aerospace market, and we are reviewing our order book and making the necessary adjustments operationally to ensure that we can continue capitalizing on these opportunities throughout the year.”

Third Quarter Results

Net sales for the third quarter of fiscal 2012 were $95.1 million, an increase of 17.0% from $81.3 million in the third quarter of fiscal 2011. The increase of 17.0% was driven by an increase of 18.0% in our industrial business and by a 16.1% increase in net sales in our aerospace and defense business. Gross margin for the third quarter was $33.6 million compared to $26.0 million for the same period last year. Gross margin as a percentage of net sales was 35.4% in the third quarter of fiscal 2012 compared to 32.0% for the same period last year.

Operating income increased 49.2% to $18.2 million for the third quarter of fiscal 2012 compared to $12.2 million for the same period last year. As a percentage of net sales, operating income was 19.1% compared to 15.0% for the same period last year.

Interest expense, net for the third quarter of fiscal 2012 was $0.2 million compared to $0.4 million for the same period last year.

Income tax expense for the third quarter of fiscal 2012 was $5.8 million, an effective income tax rate of 32.1% compared to income tax expense of $4.0 million, an effective rate of 35.1% for the same period last year. The effective income tax rate for the third quarter of fiscal 2012 includes $0.4 million in discrete items. The effective income tax rate for the third quarter fiscal 2012 excluding these discrete items would have been 34.5%.

For the third quarter of fiscal 2012, the Company reported net income of $12.2 million compared to net income of $7.4 million in the same period last year. Diluted EPS for the third quarter of fiscal 2012 increased 63.6% to $0.54 per share compared to $0.33 per share for the same period last year.

Nine Month Results

Net sales for the nine month period ended December 31, 2011 were $286.2 million, an increase of 16.0% from $246.7 million for the nine month period ended January 1, 2011. Both our industrial and aerospace and defense markets contributed equally to this increase in net sales. Gross margin for the nine month period ended December 31, 2011 was $99.4 million compared to $79.5 million for the same period last year. Gross margin as a percentage of net sales was 34.7% for the nine month period of fiscal 2012 compared to 32.2% for the same period last year.

For the nine month period ended December 31, 2011, the Company reported operating income of $53.6 million compared to $40.1 million for the same period last year. Operating income as a percentage of net sales was 18.7% for the nine month period ended December 31, 2011 compared to 16.3% for the same period last year.

Interest expense, net for the nine month period ended December 31, 2011 was $0.9 million, a decrease of $0.3 million, from $1.2 million for the same period last year.

Income tax expense for the nine month period ended December 31, 2011 was $17.6 million, an effective income tax rate of 33.8% compared to income tax expense of $12.7 million, an effective income tax rate of 33.7%, for the same period last year. The effective income tax rate for the nine month period for this year and last year include discrete items of $0.4 million and $0.6 million, respectively. Excluding these discrete items, the effective tax rate for the nine months ended December 31, 2011 would have been 34.5% compared to 35.2% for the same nine month period last year.

Net income for the nine month period ended December 31, 2011 was $34.5 million compared to net income of $25.0 million for the same period last year. Diluted EPS for the nine months ended December 31, 2011 was $1.54 per share compared to $1.14 per share for the same period last year.

Live Webcast

RBC Bearings Incorporated will host a webcast at 11:00 a.m. ET today to discuss the quarterly results. To access the webcast, go to the investor relations portion of the Company’s website, www.rbcbearings.com, and click on the webcast icon. If you do not have access to the Internet and wish to listen to the call, dial 866-713-8567 (international callers dial 617-597-5326) and enter conference ID # 20565187. An audio replay of the call will be available from 1:00 p.m. ET on Wednesday, February 8th until 11:59 p.m. ET on Wednesday, February 15th. The replay can be accessed by dialing 888-286-8010 (international callers dial 617-801-6888) and entering conference call ID # 92328357. Investors are advised to dial into the call at least ten minutes prior to the call to register.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and marketer of highly engineered precision bearings and components. Founded in 1919, the Company is primarily focused on producing highly technical or regulated bearing products requiring sophisticated design, testing, and manufacturing capabilities for the diversified industrial, aerospace and defense markets. Headquartered in Oxford, Connecticut, RBC Bearings currently employs approximately 2,086 people and operates 23 manufacturing facilities in four countries.

1.The news above mentioned with detailed source are from internet.We are trying our best to assure they are accurate ,timely and safe so as to let bearing users and sellers read more related info.However, it doesn't mean we agree with any point of view referred in above contents and we are not responsible for the authenticity. If you want to publish the news,please note the source and you will be legally responsible for the news published.

2.All news edited and translated by us are specially noted the source"CBCC".

3.For investors,please be cautious for all news.We don't bear any damage brought by late and inaccurate news.

4.If the news we published involves copyright of yours,just let us know.

Next SKF Honours Authorised Distributors for Business Excellence

BRIEF INTRODUCTION

Cnbearing is the No.1 bearing inquiry system and information service in China, dedicated to helping all bearing users and sellers throughout the world.

Cnbearing is supported by China National Bearing Industry Association, whose operation online is charged by China Bearing Unisun Tech. Co., Ltd.

China Bearing Unisun Tech. Co., Ltd owns all the rights. Since 2000, over 3,000 companies have been registered and enjoyed the company' s complete skillful service, which ranking many aspects in bearing industry at home and abroad with the most authority practical devices in China.